Money is a difficult thing to manage. When we have it, everything is good and many of us fall into the temptation of spending it while it’s there. The trouble is, things can go wrong; cars can break down and utilities around the house can stop working.

If we spend all of our money, it leaves nothing for these emergencies and they have a nasty habit of cropping up at the end of the month when there’s nothing left in the bank.

Read our guide to managing your finances more effectively and see if you can better prepare yourself for when things go wrong.

1. Stick to your budget

Creating a budget is another way to stop yourself from overspending. Look at what you bring in and think about what you need to spend on the essentials. Food, utility and housing bills, as well as clothing costs, should all be included.

Creating a budget helps you keep track of exactly what you spend and helps to remove the temptation to buy things that you don’t really need.

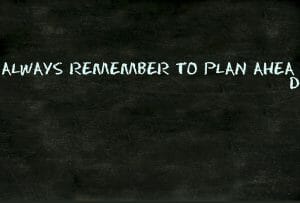

2. Plan ahead

It’s important to be realistic and understand that some months will see a higher expenditure, perhaps because of gift-giving times of the year, an event you need to attend or a holiday that is booked.

Try to be strategic and put off or bring forward bigger purchases to avoid a clash. What’s more, when working out your budget, always try to set some money aside for emergencies that you can’t plan for too.

Even putting away the cost of a coffee every week will soon add up to a nice safety net. Some banks also offer options to save the loose change from your card payments, so you’ll barely even notice you’re saving.

3. Question every purchase

If you often succumb to impulse buys, now is the time to start asking probing questions about every purchase.

Do you really need the item that you are looking to buy? If so, could you get it cheaper elsewhere or is there a discount available online?

Perhaps you can put it off till next month? For personal indulgences, holding every item up to a higher standard and picking out the item’s faults will make it easier to say no.

Remember, that the best way to manage those emergencies is to try and make sure that you put some money aside for them. We understand that this is not always easy.

Some months will be more difficult than others and sometimes disasters can happen that wipe out your savings. That’s what we’re here for. If you need a short term or payday loan, head to LoanPigUSA.com, we’re ready to help you out.