What Is Impacting Your Credit Score?

Your credit score is a three-digit number which is based on the information provided in your credit report. Your credit score is one of the many factors direct lenders and referral services use to see if you are eligible to apply for a loan from or through them. This is because it gives them a rough idea as to whether or not you are creditworthy when applying for a loan. Although many lenders do still offer loans for those with bad credit, it can work out easier and a lot cheaper for those who have a ‘good’ credit score.

Before understanding how you can build your credit score, you need to understand what is impacting it. This way you will gain a better understanding of your credit and how you can manage it.

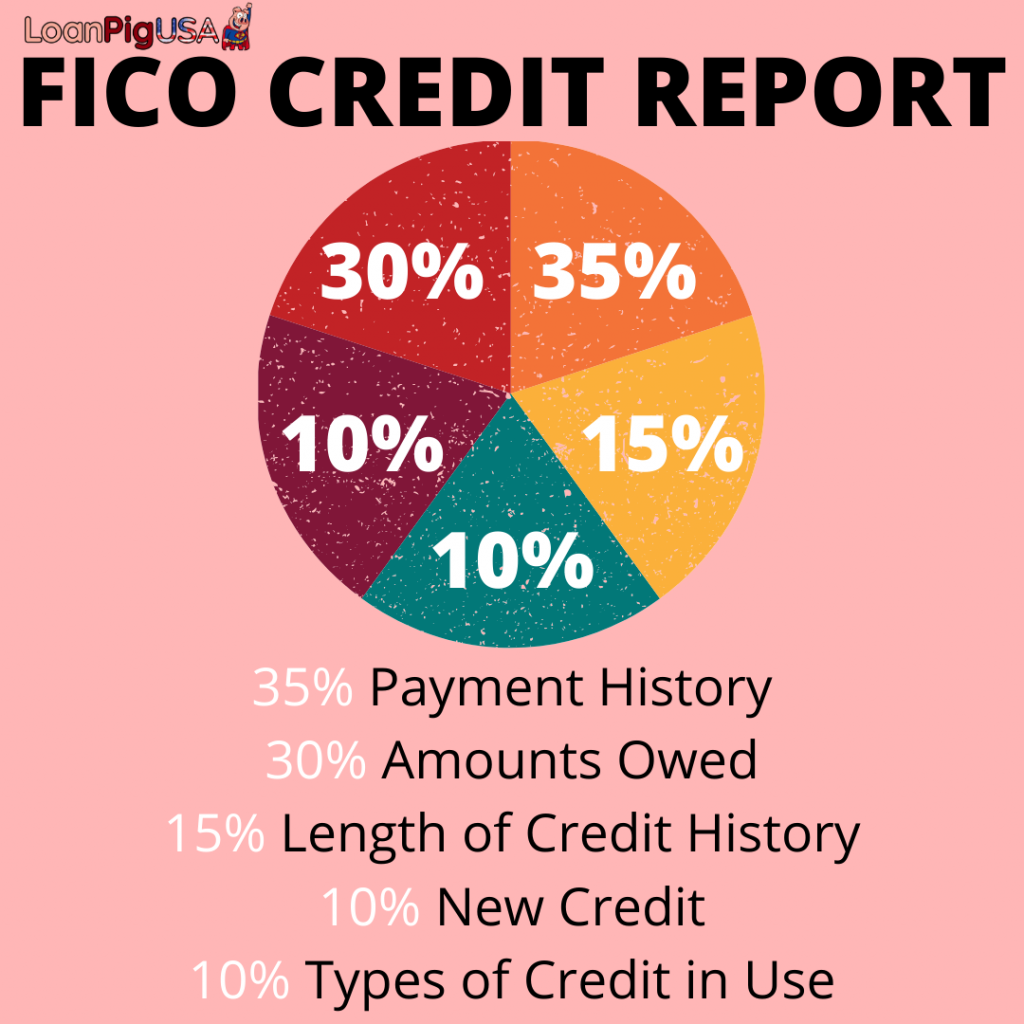

FICO Credit Score

Over the whole of the United States, the biggest, most well-known name when it comes to credit scores is FICO. When lenders and banks are deciding whether or not they should lend to somebody, it is likely that they are using FICO to help. Understanding the FICO credit score calculation process is also something you should consider learning about when it comes to your credit score. As follows is what you should know:

- 35%: payment history

- 30%: amounts owed

- 15%: length of credit history

- 10%: new credit and recently opened accounts

- 10%: types of credit in use

So What Is Lowering Your Credit Score?

There are many things which can lower your credit score, some are pretty obvious and other things you would never have guessed. Depending on the depth of knowledge of credit scores, what they are, and how they work, you may already know some of our examples. But, there is no harm in recapping right?

Late or Missed Repayments

Late or missed repayments come under the category of payment history which works out at 35% of your report. Meaning that if you miss or repay something late, the chances of it affecting your credit score are very high. But, it also depends on when the lender reports the late or missed repayments. This also includes CCJs.

You Made A New Application For Credit

Every time you apply for new credit, an inquiry is added to your credit report. New credit and recently opened accounts equate to 10% of your report so when applying you should bear this in mind.

The Age Of Your Accounts

A longer history shows you have more experience using credit. Having a longer credit history can be at your advantage as a lender can make a more accurate decision on determining the level of risk when lending to you. Although, don’t forget that this is only one of the many factors which are considered when dealing with borrowing.

Mistakes On Your Credit Report

Mistakes on credit reports are not something that happens all the time, but they do happen once in a while. The result could impact your credit score negatively so you need to make sure there are no mistakes when you can.

Common errors include:

- Incorrect Names

- Addresses

- Account Status

- Debt Status

Active Credit

If you have no active credit you might find it harder to be approved for any credit. This is because the lenders do not have any information on you and how you work with your credit. This could lead to them seeing you as a greater risk. Although, again, when borrowing there are certain lenders have other loans

To learn more about how to fix a broken credit score click here.