Lending States

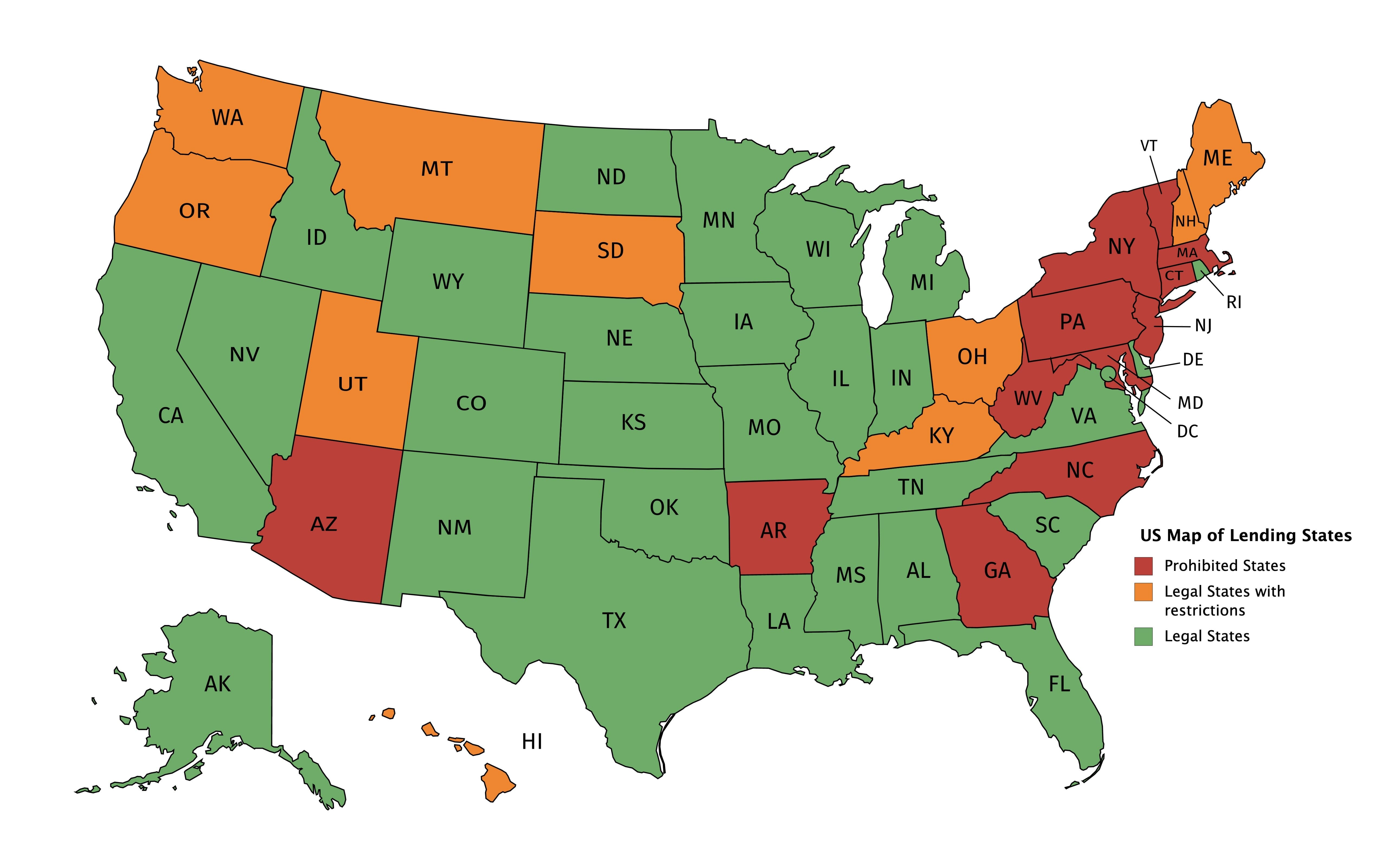

Payday lending is legal in 28 states, with 10 other states allowing some form of short term storefront lending with restrictions. The remaining 12 and the District of Columbia forbid the practice. Discover the states where payday lending is legal… the ‘lending states’.

US map of Lending States

Lending Laws By State

Lending states include: Alabama, Alaska, California, Delaware, Florida, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, North Dakota, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Virginia, Washington DC, Wisconsin, and Wyoming.

Alabama – Payday loans are legal in Alabama and governed by state statute 5-18A-1 et seq.

Alaska – Payday loans are legal in Alaska and governed by state statute 06.50.010 et seq.

California – Payday loans are legal in California and payday lenders need to be licensed and follow state laws.

Colorado – Short-term loans are legal in Colorado and governed by state statute 5-3.1-101 et seq.

Delaware – Payday loans are legal in Delaware and payday lenders are required to be licensed.

Florida – Short-term loans are legal in Florida and payday lenders to be licensed and follow state laws.

Idaho – Payday loans are legal in Idaho and governed by state statute 28-46-401 et seq.

Illinois – Payday loans are legal in Illinois and governed by state statute 815 ILCS 122 et seq.

Indiana – Payday loans are legal in Indiana and are governed by Indiana Code Ann. 24-4-4.5-7-101 et seq.

Iowa – Payday loans are legal in Iowa and governed by Iowa Code Ann. 533D.1 et seq.

Kansas – Payday loans are legal in Kansas and governed by state statutes § 16a-2-404 and -405.

Louisiana – Payday loans up to $350 are legal in Louisiana and governed by state statutes §§ 9:3578.1 et seq.

Michigan – Payday loans are allowed in Michigan.

Minnesota – State Statutes 47.60 et seq. governs payday loans in Minnesota and payday lenders must be registered and abide by laws.

Mississippi – Payday loans in Mississippi are governed by Mississippi Code Ann. 75-67-501 et seq.

Missouri – Payday loans are governed by Missouri Revised Statutes §§ 408.500.1 et seq. All lenders must be licensed.

Nebraska – Payday loans are legal in Nebraska and governed by Nebraska Statutes Annotated §§ 45-901.

Nevada – Payday loans are legal in Nevada and are governed by Nevada Revised Statutes 604A.010 et seq.

North Dakota – The North Dakota Century Code 13-08-01 et seq. governs payday lending and lenders need to be licensed and follow laws.

Oklahoma – Payday loans are legal in Oklahoma and are governed by state statutes 59 §§ 3101 et seq.

Rhode Island – Rhode Island Statutes Ann. 19-14.4-1 et seq. govern payday lending.

South Carolina – Payday loans are legal under South Carolina Code §§ 34-39-110 et seq.

Tennessee – Payday loans are governed by the Tennessee Code Ann. 45-17-101 et seq.

Texas – Payday loans are legal in Texas and regulate how long you can take to pay it back.

Virginia – Payday lending is legal in Virginia and governed by Virginia Code Ann. §§ 6.2-1800 et seq.

Washington DC – Payday loans aren’t illegal in Washington DC but although they aren’t specifically banned, payday lenders choose not to offer loans because of the cap on interest.

Wisconsin – Payday loans are legal in Wisconsin. and state statutes 138.14 controls payday lending.

Wyoming – All payday loans fall under Wyoming Statutes 40-14-362.

States where payday lending is legal with restrictions

Lending states with restrictions include: Hawaii, Kentucky, Maine, Montana New Hampshire, New Mexico, Ohio, Oregon, South Dakota, Utah, and Washington.

Hawaii – Payday loans are legal in Hawaii and are governed by state statute 480F-1 et seq. However, only applies to check cashers only.

Kentucky – Payday loans are legal in Kentucky and are governed by state statute ann. §§ 286.9.010 et seq. However, only applies to check cashers only.

Maine – Payday loans are legal in Maine, however, they are permitted for supervised lenders only.

Montana – Payday lending is legal in Montana and is governed by Montana Code Annotated 31-1-701 et seq. They are legal at a low cost.

New Hampshire – Payday loans are legal in New Hampshire and are governed by state statute 399-A:1 et seq. They are legal at a low cost.

New Mexico – Payday loans used to be legal in the state of New Mexico, as of January 1, 2018, they no longer are except refund anticipation loans.

Ohio – Under the Ohio Revised Code Ann. 1321.35 et seq, payday loans have an interest rate cap of 28%.

Oregon – Payday loans are governed by 54 Oregon Revised Statute § 725A.010 et seq. They are legal at a low cost.

South Dakota – Payday loans are legal under South Carolina Code §§ 34-39-110 et seq.

Utah – Utah Code Ann. 7-23-101 et seq., the Check Cashing Registration Act, governs the operation of all payday lenders in Utah. However, only applies to check cashers only.

Washington – Washington Revised Code Ann. 31.45.010 et seq. governs payday lenders. A lender must have a small loan endorsement to their check casher license.

States where payday lending is prohibited

Prohibited states include: Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont and West Virginia.

Arizona – The law that permitted payday loans in Arizona expired on June 30, 2010.

Arkansas – Payday loans aren’t legal in Arkansas. The Check Casher Act, as defined by Arkansas Code 23-52-101 et. seq, was repealed in 2011.

Connecticut – Payday loans are illegal in Connecticut. The General Statutes of Connecticut 36a-563 et seq. apply to all small loans.

Georgia – Payday loans aren’t legal in Georgia. Small loans are heavily regulated and governed by statutes 16-17-1 et seq., 7-3-14 et seq. and 80 3-1.02(7).

Maryland – Payday loans aren’t legal in Maryland. Maryland Law § 12-101 et seq. prohibits payday lending in all forms.

Massachusetts – Payday lending itself isn’t illegal, the high APR lenders charge is — which means payday lenders don’t operate in the state.

New Jersey – New Jersey Revised Statutes 17:15A-47 states that a check cashing licensee can’t advance money or cash a postdated check.

New York – A check casher licensee cannot make loans nor cash or advance any money on a postdated check unless it is a payroll check.

North Carolina – Payday loans are illegal in North Carolina and has been prohibited since 2001.

Pennsylvania – Under the Check Cashing Licensing Act of 1998, 505(a), lenders are prohibited from issuing a loan as an advance on a postdated check.

Vermont – Payday lending is prohibited in Vermont, this applies to all small loan lenders in the state.

West Virginia – Payday loans are prohibited under West Virginia Code 46A-4-107 and 32A-3-1 et. seq.

For more information on lending states, see here.